Today is pay day so I'm checking in with all of my finances and bills.

What I Have:

Checking Account: $1,313.28

Savings: $1,823.94

Wallet: nada

What I Owe:

Student Loan: $84,162.72

Credit Card: 248.55

Where my money is going:

I'm paying my typical 1st of the month loan payment of $745.60 and rent is $400, that leaves me with $167.68. I'm going to make a $100 payment on my credit card. I might pay off the rest of the card from money in my savings.

Why is my card so high? OKAY. So I know I'm on a vague-ish spending freeze. However, there are some things in life that I really, really, reallllllly want to do. Bucket list things (I plan on making a post about them later!). One of them is laser hair removal. I know that sounds lame since most people's bucket list items are like, climb a mount, see Spain, blah blah blah. Well good for you but I don't want to ever shave my armpits again. A bunch of people I work with have had it done and I felt the results and they are so freakin' amazing. I'm not sure what I was expecting but I was totally blown away by the quality of the work. Anyway, I had pretty much made up my mind that I wanted it done and then just yesterday I get an Amazon Local deal saying I could get 6 treatments on a small area for only $99. That is absurd. Most places charge any where from $600-$1000 for small areas. I checked online and the places reviews are good and I called and asked a bunch of questions. As I was talking to the lady I ended up just purchasing the package.

Yes, I should spend $99 towards bills or food or gas or whatever but I have ZERO regrets about doing something awesome for myself. Especially because of how much money I'm saving. I go in for my first appointment tomorrow. I've already decided that once this area is all done I'm going to do my legs (at least the lower half) sometime next year. Because I'm broke/cheap I'll wait until there's a great deal but when that deal comes up I won't feel any guilt about getting it :)

Friday, May 31, 2013

Wednesday, May 29, 2013

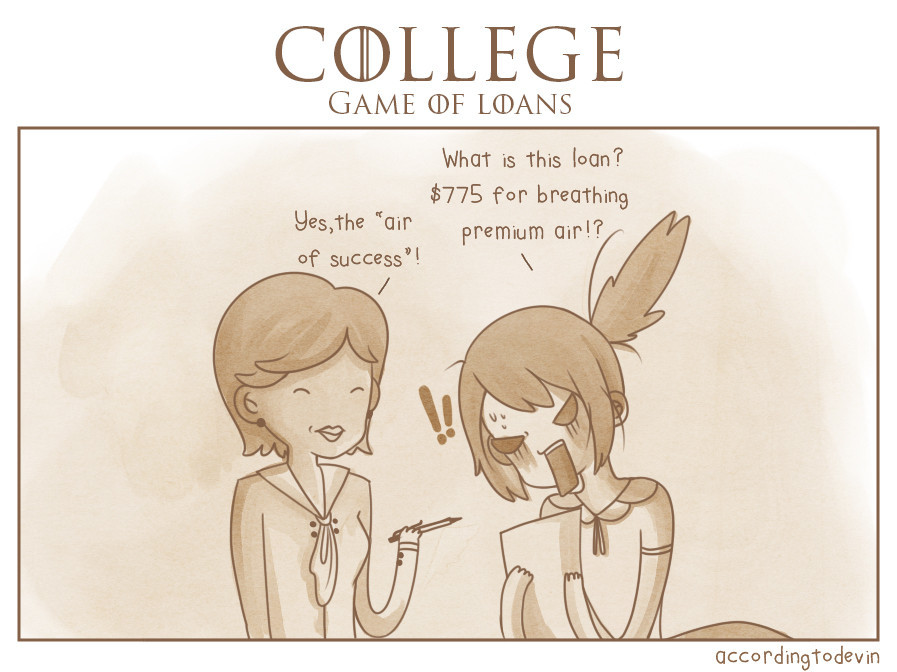

This about sums it up

I have no problem paying off my student loans but let's take a real long look at what my generation has had to pay in tuition fees and interest rates. This shit is ridiculous.

Tuesday, May 28, 2013

You Might Be Broke If......

-You've ever re-used a coffee filter

-You have no shame in using rubber bands and tape to hold together everyday items

-You can easily ignore any sound that might mean an appliance is breaking

-You have paid for groceries in loose change

-You experience overwhelming joy when there's free food at work

Sunday, May 19, 2013

Financial Update: After Bill Pay

So I did a Pay Day check in a few days ago but I wanted to re-check in (checker in? No, that's not right...) to see my finances after I spent a late Mother's Day with my Mom and after most of my bill payments went through.

Checking: $152.42

Savings: $1822.20

Pocket Book: Like $2 bucks?? I spent the remainder of my cash on Powerball tickets (that did not go well).

What I owe on my credit card: $119.92

What I owe Wells Fargo: $84,162.72

I treated my mom to lunch which cost $50 (put on my credit card) BUT she treated me to a full tank of gas, a hair cut, and a mani/pedi. I might go ahead and pay another $50 or so on my credit card but probably closer to next pay day. I still need to go grocery shopping but that should only cost me around $50.

I can't believe how far down my loan has gone in only 5 months. I'm so close to paying off $10,000 in principle. I think once that happens (and I potentially get a raise sometime in October) I might start shifting around how much I pay. I want to help my mom with the student loan that she has for me. She owes around $38k and I'd like to help her pay it off so she can save for retirement.

I keep looking at the financial road map I made; in just two years I will be close to only owing around $50,000. Then I can slow down on the payments and start saving for a house. I try to broach the idea of buying a house with my boyfriend but he doesn't really seem that into it which is a bummer but not terribly unexpected. Like most things in life I'll probably do that on my own (or with the help of my mom, haha). I figure I can easily save up the $20,000 or so down payment and I should have rocking credit so hopefully I can find a cute little house to call my own.

Checking: $152.42

Savings: $1822.20

Pocket Book: Like $2 bucks?? I spent the remainder of my cash on Powerball tickets (that did not go well).

What I owe on my credit card: $119.92

What I owe Wells Fargo: $84,162.72

I treated my mom to lunch which cost $50 (put on my credit card) BUT she treated me to a full tank of gas, a hair cut, and a mani/pedi. I might go ahead and pay another $50 or so on my credit card but probably closer to next pay day. I still need to go grocery shopping but that should only cost me around $50.

I can't believe how far down my loan has gone in only 5 months. I'm so close to paying off $10,000 in principle. I think once that happens (and I potentially get a raise sometime in October) I might start shifting around how much I pay. I want to help my mom with the student loan that she has for me. She owes around $38k and I'd like to help her pay it off so she can save for retirement.

I keep looking at the financial road map I made; in just two years I will be close to only owing around $50,000. Then I can slow down on the payments and start saving for a house. I try to broach the idea of buying a house with my boyfriend but he doesn't really seem that into it which is a bummer but not terribly unexpected. Like most things in life I'll probably do that on my own (or with the help of my mom, haha). I figure I can easily save up the $20,000 or so down payment and I should have rocking credit so hopefully I can find a cute little house to call my own.

Wednesday, May 15, 2013

Pay Day Finances

I want to start monitoring my spending/debt more closely. I feel that it will help to keep me more strict and honest with my budget plus it really feeds my Type A personality to organize everything.

Today I got paid (yay!) which means that I have to go in and pay all my bills (boo!). Here's the current breakdown:

What I have:

Checking: $1318.93

Savings: $1825.18

Pocket book: $20 from babysitting

What I owe:

Credit card: $109.36

Utilities: $116.51

I plan on using the money I have from babysitting to put gas into my tank (I'm going home this weekend for a late mother's day and will definitely need it). I'm also babysitting tonight and the $30 or $40 bucks I earn from that will go towards paying for photos I had printed for my Mom's Mother's Day gift (only $10!) and then a birthday happy hour I plan on attending this Friday. If I pay all of my bills plus my usual $1000 on my student loans I will only have $93 left in my checking and I will have put nothing away for savings. Sort of a bummer.

My plan is to pay my utility bill in full (because lights and air conditioning are pretty nifty), pay $50 towards my credit card, and pay $1000 towards my student loan.

I find the only way I can stomach paying so much on my student loan is to do it very early in the morning on pay day. That way I'm still sleepy/out of it and my brain doesn't have time to process all the fun things I could do with an extra grand each month. Plus, since it's pay day I'm not used to seeing so much in my bank account. Most days when I log into my account I see something awesome like I only have $27 bucks to live on for 2 weeks.

The thing that makes it easier is that I'm telling myself that I'm just doing it for one year. Now I do have a 5 year plan to pay off my 90k student loan but all I'm holding myself accountable for is one year. I just have to pay a lot this year and next year things will be easier. I will have paid it (hopefully) down into the $70,000 ish area which will be easier to deal with/look at/live with than 90K. Once I've done my first year I'll look at my budget and realize that by the end of year two I should have it down to around $50k. Once I get it below $50k I can slow down a bit. The interest each month will be lower, it's a more typical student loan amount than close to $100k. I'll be able to save more for a house and maybe even feel more comfortable spending money on fun things. I've just got to take it one pay day at a time.

Today I got paid (yay!) which means that I have to go in and pay all my bills (boo!). Here's the current breakdown:

What I have:

Checking: $1318.93

Savings: $1825.18

Pocket book: $20 from babysitting

What I owe:

Credit card: $109.36

Utilities: $116.51

I plan on using the money I have from babysitting to put gas into my tank (I'm going home this weekend for a late mother's day and will definitely need it). I'm also babysitting tonight and the $30 or $40 bucks I earn from that will go towards paying for photos I had printed for my Mom's Mother's Day gift (only $10!) and then a birthday happy hour I plan on attending this Friday. If I pay all of my bills plus my usual $1000 on my student loans I will only have $93 left in my checking and I will have put nothing away for savings. Sort of a bummer.

My plan is to pay my utility bill in full (because lights and air conditioning are pretty nifty), pay $50 towards my credit card, and pay $1000 towards my student loan.

I find the only way I can stomach paying so much on my student loan is to do it very early in the morning on pay day. That way I'm still sleepy/out of it and my brain doesn't have time to process all the fun things I could do with an extra grand each month. Plus, since it's pay day I'm not used to seeing so much in my bank account. Most days when I log into my account I see something awesome like I only have $27 bucks to live on for 2 weeks.

The thing that makes it easier is that I'm telling myself that I'm just doing it for one year. Now I do have a 5 year plan to pay off my 90k student loan but all I'm holding myself accountable for is one year. I just have to pay a lot this year and next year things will be easier. I will have paid it (hopefully) down into the $70,000 ish area which will be easier to deal with/look at/live with than 90K. Once I've done my first year I'll look at my budget and realize that by the end of year two I should have it down to around $50k. Once I get it below $50k I can slow down a bit. The interest each month will be lower, it's a more typical student loan amount than close to $100k. I'll be able to save more for a house and maybe even feel more comfortable spending money on fun things. I've just got to take it one pay day at a time.

Sunday, May 5, 2013

Birthday on the Cheap!

I just spent an amazing birthday weekend with my sister and I'm pretty proud of how I kept my spending under control.

Here's the wrap-up

Food:

I mentioned in my last post about how cheap and easy home made birthday cake and ice cream is. But, most people don't like to live off of just cake and sweets so we had to pick up some food and drinks. If you've read this blog at all you know I fancy booze and my absolute favorite liquor store is Cost Co. You don't have to be a member to purchase liquor (at least at the one's in Texas, they have a separate room for the hard liquor and any one can buy from it). My sister and I picked up a giant bottle of Tequila for only $20 bucks and then went to HEB and got some regular house food (morning and lunch staples like bagels, bananas, eggs, and yogurt) as well as ingredients for quesadillas. My total bill was only $44 bucks which isn't the best but not too bad for food for a week.

Entertainment

My sister loves coming up to Austin and shopping at stores they don't have in her town. We entertained ourselves for hours on window shopping. We're also both pop culture shows so we watched a ton of TV and movies. She had purchased the tickets for the show earlier so that was a cost I didn't have to worry about.

Unnecessary but lovely purchase:

Bought my boyfriend lunch at a great gourmet burger joint (my sister insisted on paying for herself): $28 bucks

A new pair of Betsey Johnson sunglasses: $20 bucks

A new wall plug and 3 new scents from Bath and Body Works:$20

Yes, it was unnecessary and not really apart of my budget to spend $68 dollars on these things. BUT I manage to live off of around $300 a month (covering my utility bill, gas, food, and social life) because I spend every other dime on student loans. I haven't purchased new sunglasses in more than 5 years. The one's I have been using were a pair of Betsey Johnson's my ex bought for me years ago.

Here are my new glasses:

Here's the wrap-up

Food:

I mentioned in my last post about how cheap and easy home made birthday cake and ice cream is. But, most people don't like to live off of just cake and sweets so we had to pick up some food and drinks. If you've read this blog at all you know I fancy booze and my absolute favorite liquor store is Cost Co. You don't have to be a member to purchase liquor (at least at the one's in Texas, they have a separate room for the hard liquor and any one can buy from it). My sister and I picked up a giant bottle of Tequila for only $20 bucks and then went to HEB and got some regular house food (morning and lunch staples like bagels, bananas, eggs, and yogurt) as well as ingredients for quesadillas. My total bill was only $44 bucks which isn't the best but not too bad for food for a week.

Entertainment

My sister loves coming up to Austin and shopping at stores they don't have in her town. We entertained ourselves for hours on window shopping. We're also both pop culture shows so we watched a ton of TV and movies. She had purchased the tickets for the show earlier so that was a cost I didn't have to worry about.

Unnecessary but lovely purchase:

Bought my boyfriend lunch at a great gourmet burger joint (my sister insisted on paying for herself): $28 bucks

A new pair of Betsey Johnson sunglasses: $20 bucks

A new wall plug and 3 new scents from Bath and Body Works:$20

Yes, it was unnecessary and not really apart of my budget to spend $68 dollars on these things. BUT I manage to live off of around $300 a month (covering my utility bill, gas, food, and social life) because I spend every other dime on student loans. I haven't purchased new sunglasses in more than 5 years. The one's I have been using were a pair of Betsey Johnson's my ex bought for me years ago.

Here are my new glasses:

They were originally around $70 so paying only $20 for them was a steal. Plus they came with an adorable bright pink sunglass case.

I feel pretty good about this weekend. I have around $70 in my checking account and around $100 on my credit card. I don't have any bills on my credit card due and when I get paid on the 15th I can pay off my credit card and add a little more to my savings.

I've mentioned before how much I really enjoy And Then We Saved. Their big idea is a spending fast. Basically spending on only the absolute necessities (food, housing) and either saving the rest or paying off debt. I realized that even though I sometimes spend some cash on unnecessary things I'm pretty much on spending fast. 70% of my income goes towards student loans (literally, I did math to figure that out, that's not just a guess). And like I said above the rest is spent on rent, food, gas, and utilities. Yes, anything after that probably could go into savings but I'm glad it goes into fun things like Fun Run races (I did the color run this weekend and it was amazing!) or shoes or sunglasses or unnecessary scent thingies from Bath and Body Works.

Friday, May 3, 2013

My Sister's Bday Weekend

My sister is coming up to celebrate her birthday weekend and I'm excited/nervous to host and entertain under a budget. We're going to go and see a show and then spend the rest of the weekend hanging out and enjoying quality time.

I'm hoping that I can keep track of my spending this week. Here's what's gone down so far:

Birthday Cake:

$1 on chocolate cake mix

$2 on 2 chobani yogurts

=

$3 cake!!!

Ice Cream and Cake Icing:

$1 on small container of whole milk

$3 on large container of heavy cream

=$4 birthday extras!

I have an ice cream machine and I'm a pro at making my own icings from my vegan days so whipping up the cake extras was a breeze. It's pretty incredible to spend $7 bucks for cake and ice cream.

Birthday Gift:

$1 on basket

$12 on two bags of specialty coffee

$2 for 2 cute dollar store mugs

=

$15 Bday present

Pinterest has been a great inspiration for cheap but great basket gifts. My sister loves coffee and presenting coffee plus mugs in a basket makes it seem like such a bigger gift. I really hope she enjoys it.

Once she gets here we're going to stop by the grocery store to pick up food (eating in is much cheaper than dining out constantly). I'm so incredible excited for this weekend :)

I'm hoping that I can keep track of my spending this week. Here's what's gone down so far:

Birthday Cake:

$1 on chocolate cake mix

$2 on 2 chobani yogurts

=

$3 cake!!!

Ice Cream and Cake Icing:

$1 on small container of whole milk

$3 on large container of heavy cream

=$4 birthday extras!

I have an ice cream machine and I'm a pro at making my own icings from my vegan days so whipping up the cake extras was a breeze. It's pretty incredible to spend $7 bucks for cake and ice cream.

Birthday Gift:

$1 on basket

$12 on two bags of specialty coffee

$2 for 2 cute dollar store mugs

=

$15 Bday present

Pinterest has been a great inspiration for cheap but great basket gifts. My sister loves coffee and presenting coffee plus mugs in a basket makes it seem like such a bigger gift. I really hope she enjoys it.

Once she gets here we're going to stop by the grocery store to pick up food (eating in is much cheaper than dining out constantly). I'm so incredible excited for this weekend :)

Subscribe to:

Posts (Atom)